Automated Payroll System

In today's fast-paced business environment, the pursuit of efficiency and accuracy in financial operations is paramount. An automated payroll management system represents a significant leap forward from the labour-intensive, error-prone processes that once dominated the field. By integrating advanced technologies into the realm of payroll, businesses of all sizes can not only reduce the workload on their HR departments but also enhance employee satisfaction.

What is an Automated Payroll Management System?

An automated payroll management system is a software solution designed to handle the payroll functions of a business efficiently and with minimal human intervention. This technology simplifies the complex task of managing employee compensation, deductions, taxes, and other payroll-related data by automating the processes.

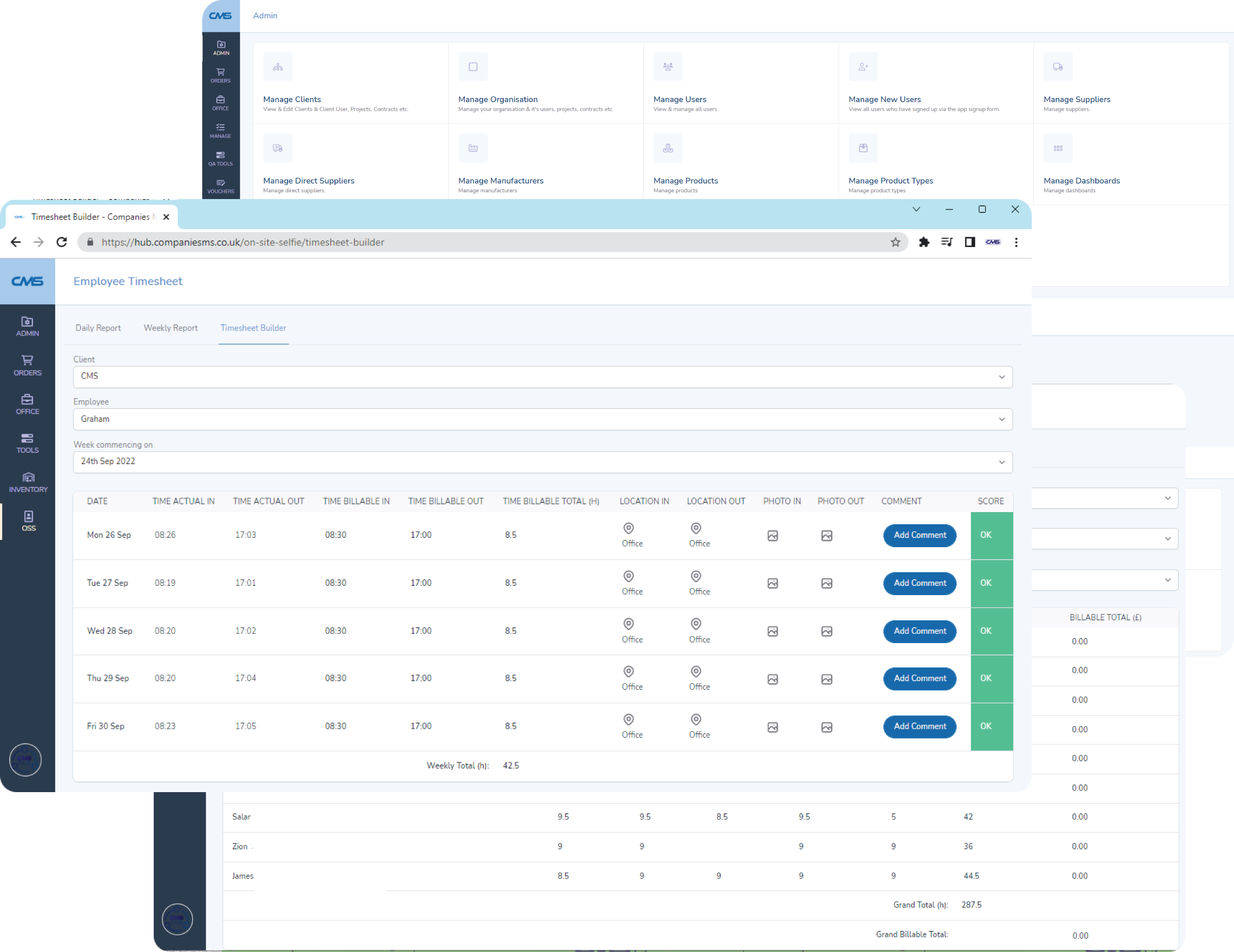

At its core, an automated payroll system is driven by robust software that integrates into a company's human resources and accounting systems. The system automates everything from calculating pay based on hours worked, including overtime and bonuses, to processing deductions like taxes, insurance premiums, and retirement contributions. It ensures that employees are paid accurately and on time, directly depositing their salaries into their bank accounts.

Furthermore, employee payroll management system is equipped with features that handle regulatory compliance issues, tax filings, and reporting requirements automatically. It remains updated with the latest tax laws and regulatory changes, reducing the risk of errors that can lead to penalties or legal issues. By maintaining detailed records of all payroll activities, automated payroll system also provides valuable data that can be used for financial analysis, budgeting, and forecasting.

How to Optimize Your Payroll Process: Benefits of an Automated Payroll System

Optimizing your payroll process using an automated payroll system brings a multitude of benefits that can significantly enhance the efficiency and accuracy of your business's financial operations. The key benefits include:

- simplification of the complex calculations involved in payroll processing,

- integration with other business systems like HR management and accounting software,

- compliance with tax laws and regulations,

- advanced data security,

- scalability.

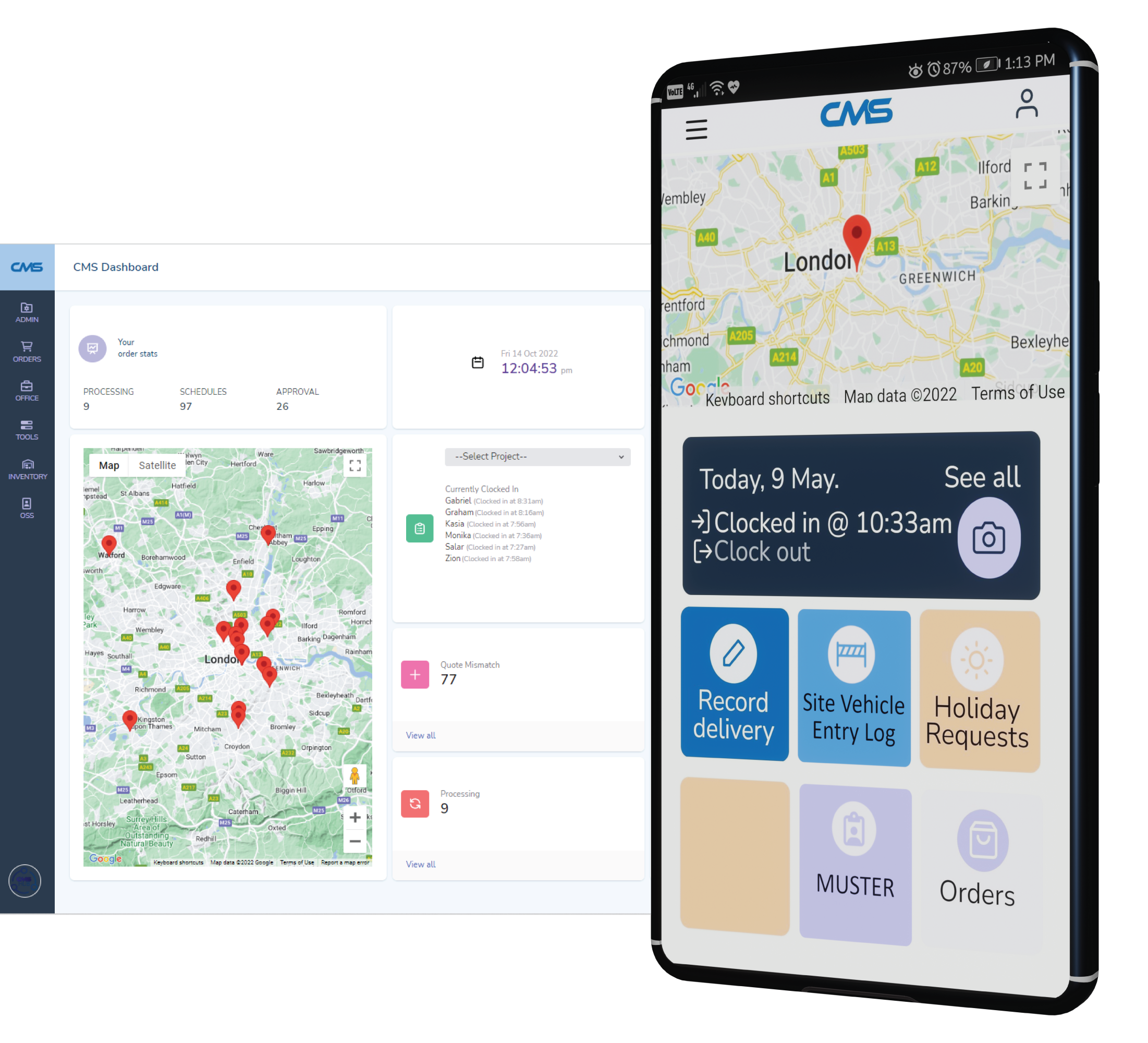

By optimizing your payroll process with CMS solutions, you not only enhance operational efficiencies but also improve overall business performance. An automated payroll system is an investment that pays dividends by saving time, reducing errors, and ensuring compliance, all of which contribute to a more streamlined, efficient, and compliant organization.

Types of Payroll Management System

Payroll management systems come in various forms, each designed to cater to different business needs and operational scales. The main types of employee payroll management systems you can choose from include:

Standalone Payroll Systems

Standalone payroll systems are software solutions that focus solely on payroll functions without integration into other HR functions. They are ideal for businesses that require a dedicated payroll system without the need for a comprehensive HR management tool.

Integrated HR and Payroll Systems

Integrated systems combine payroll with other HR functions such as employee records management, attendance tracking, and benefits administration. These systems provide a holistic approach to HR management by ensuring that all employee-related data is interconnected. We sometimes call them HR payroll management systems. Integrated systems are particularly beneficial for medium to large businesses that require robust HR management capabilities alongside payroll processing.

Cloud-based Payroll Solutions

Cloud-based payroll solutions host all payroll data and processes on the cloud, offering businesses scalability, flexibility, and accessibility. These systems can be accessed from anywhere at any time, providing a significant advantage for businesses with remote teams or multiple locations. Cloud-based systems are maintained and updated by the service provider, ensuring compliance with the latest regulations without requiring manual updates. They also offer enhanced security features to protect sensitive payroll data.

Customizable Payroll Software

Customizable payroll software allows businesses to tailor features and workflows to fit their specific needs. This type of system is especially useful for organizations with unique payroll requirements or those in industries with complex payroll regulations. Customizable software can adapt to various payroll configurations.

On-Premise Payroll Systems

On-premise payroll systems are installed locally on a company's own computers and servers. This type of system gives businesses full control over the payroll software and data, often preferred by organizations that require high levels of security and data privacy. On-premise systems involve a larger upfront investment in IT infrastructure and maintenance but can be more cost-effective in the long run for larger companies.

Peter Szczypulkowski

Elmech, Director

“In use on all our projects, really showed us the advantage to true time keeping with the operators aware they are responsible for all entries”.

Companies Management Systems

Unit 1, 30B

Wild’s Rents London

SE1 4QG